Readers: this blog is set in the future (sometime after the year 2020). Each entry assumes there has been a 5th revolution in the US — the Revenge Revolution. More about the Revenge Revolution and author, Entry #1. Most entries are formatted as conversations. Characters appear in a number of entries, with many entries building on previous conversations.

Occasionally I break from the normal formatting and do a “sense check.” Auditing one’s own work is problematic but I try to be objective. Entries #300 and #301 are the most recent “sense checks.” Your thoughts are welcomed and appreciated. Thanks for your time and interest…and comments, please.

Scene: Jordan’s office, Washington, DC, start of workday. “Can We Talk about Economics” conversation began Entry #308.

Gelly: “Professor Jordan, now that you’ve had a break, ready to explain more economics?”

Jordan: “Professor, hardly, but yes, let’s continue. Any topic in particular?”

Gelly: “I’d like to know more about tariffs. I think I understand the concept but not sure how effective tariffs really are, especially for worker bees.”

Jordan: “OK, tell me your understanding of tariffs. Why would a country implement a tariff?”

Gelly: “First, let me make sure I understand the idea of trade between two countries. I get the part where one country might have stuff the other country needs, or makes some product more efficiently than the other country. That all seems logical. What also seems logical is that trade should be fair. Maybe I’m being naïve but shouldn’t trade between countries be like what we were all supposed to learn as kids…you know, treat your neighbor as you want to be treated?”

Gelly: “First, let me make sure I understand the idea of trade between two countries. I get the part where one country might have stuff the other country needs, or makes some product more efficiently than the other country. That all seems logical. What also seems logical is that trade should be fair. Maybe I’m being naïve but shouldn’t trade between countries be like what we were all supposed to learn as kids…you know, treat your neighbor as you want to be treated?”

Jordan: “Gelly, how do you boil complex issues down to such basic ideas? You’re right, trade should be fair to both sides.”

Gelly: “Like most any relationship, sometimes trade probably gets out of whack and one country has an advantage that needs to be adjusted. Is that what tariffs are supposed to do? Provide a balance? Or maybe protect some industry or set of products?”

Jordan: “Yes, that’s the theory. However, for trade to work long-term, the industries being protected should be considered ‘critical’ for some legiimate strategic reason.”

Gelly: “Critical such as growing and exporting coffee beans might be critical to the economy and welfare of the people of say Costa Rica? Coffee’s probably a big deal to Costa Rica but hardly of any importance to the US…other than maybe Hawaii.”

Gelly: “Critical such as growing and exporting coffee beans might be critical to the economy and welfare of the people of say Costa Rica? Coffee’s probably a big deal to Costa Rica but hardly of any importance to the US…other than maybe Hawaii.”

Jordan: “Right. Because coffee has such a major impact on its economy, Costa Rica could add tariffs to any coffee imported from say Brazil or Columbia in order to protect its economy.”

Gelly: “I get that part. Then what impact would a tariff have on exports from Costa Rica? People in Costa Rica can’t drink all the coffee grown there. If Costa Rica added tariffs to products imported from other countries…and those countries then added tariffs to Costa Rican coffee…wouldn’t that hurt exports? Tariffs seem like a two-edged sword to me.”

Jordan: “For countries with only a few products to export and where those products do not have much competition, tariffs might work. But, for most countries, tariffs are a high-risk poker game. While coffee can’t be grown in every country, in can be grown in many countries. Unless your country is a real big dog for that product or commodity, the country adding tariffs runs the risk of losing exports.”

Jordan: “For countries with only a few products to export and where those products do not have much competition, tariffs might work. But, for most countries, tariffs are a high-risk poker game. While coffee can’t be grown in every country, in can be grown in many countries. Unless your country is a real big dog for that product or commodity, the country adding tariffs runs the risk of losing exports.”

Gelly: “For countries with lots of different kinds of products – Germany, Canada, China, the US – tariffs seem a lot more complicated.”

Jordan: “I said earlier you were becoming an economist. Keep talking.”

Gelly: “Isn’t trade between countries also affected by currency rates?”

Jordan: “Yes, but put currency rates aside for a few minutes. We’ll cover that later.”

Gelly: “OK, so if the US say claimed China was selling steel at too low a price, the US might put a tariff on steel made in China or goods produced with steel made in China. But what really happens after the tariff is implemented?”

Jordan: “Well, for one thing, China can then decide to add tariffs to some goods imported in China from the US – say corn or soybeans, which is exactly what they did after Trump put tariffs on Chinese steel.”

Jordan: “Well, for one thing, China can then decide to add tariffs to some goods imported in China from the US – say corn or soybeans, which is exactly what they did after Trump put tariffs on Chinese steel.”

Gelly: “Those tit-for-tat tariffs can go on for a long time. And what do they accomplish?”

Jordan: “Good question. To answer your questions let’s look at what happened after Trump put tariffs on raw steel and aluminum from China…and Canada, of all places.”

Gelly: “Did the price of Chinese steel increase after the tariffs?”

Jordan: “Yes.”

Gelly: “Did American companies start selling more steel?”

Jordan: “Some but the US steel companies did what often happens in the US when tariffs are implemented – the US companies immediately raised prices.”

Jordan: “Some but the US steel companies did what often happens in the US when tariffs are implemented – the US companies immediately raised prices.”

Gelly: “C’mon, how much could that increase really cost a company? Couldn’t have been that much, could it?”

Jordan: “Soon after the tariffs were announced, Ford said tariffs on steel and aluminum would increase their cost at least $1,000,000,000 per year. And that’s the cost to just one company.”

Gelly: “This might sound dumb but if a company’s costs keep going up, wouldn’t the company raise prices? For Ford, they would have to increase prices of cars and trucks, right?”

Jordan: “You got it.”

Gelly: “Then, unless I’m missing something, the tariffs really end up being a tax on consumers. The government might collect revenue from the tariffs but the consumer – the working stiffs – are the ones who gets screwed.”

Gelly: “Then, unless I’m missing something, the tariffs really end up being a tax on consumers. The government might collect revenue from the tariffs but the consumer – the working stiffs – are the ones who gets screwed.”

Jordan: “Now, remember what happened to the corn and soybean farmer after Trump put tariffs on Chinese steel and then China retaliated?”

Gelly: “The Chinese didn’t stop consuming corn and soybeans…but the Chinese began buying corn and soybeans from other countries. So the tariffs caused US farmers to lose exports to a major market…and the same farmers ended up paying more for their tractor and pick-up truck. So why do tariffs like the ones Trump imposed seem so stupid?”

Jordan: “A lot Trump’s tariffs were head scratchers. In fairness, sometimes trade between countries does get out of whack. And tariffs can help resolve the issue. But tariffs are like a Band-Aid, for small wounds and to help only temporarily. There’s a better way to solve issues when trade gets out of whack…and a better way to manage trade.”

Jordan: “A lot Trump’s tariffs were head scratchers. In fairness, sometimes trade between countries does get out of whack. And tariffs can help resolve the issue. But tariffs are like a Band-Aid, for small wounds and to help only temporarily. There’s a better way to solve issues when trade gets out of whack…and a better way to manage trade.”

Gelly: “You mean like trade agreements? Agreements such as Nafta or whatever Trump tried to rename it?”

Jordan: “Yes, trade agreements. The agreements usually include what you might call a trade court. That court helps revolve issues and avoids tariffs.”

Jordan: “Yes, trade agreements. The agreements usually include what you might call a trade court. That court helps revolve issues and avoids tariffs.”

Gelly: “I’m interested in learning more but need to put this conversation on hold, please. I’ve got a conference call in a few minutes and need to get ready. Let’s continue later, OK?”

Jordan: “Deal.”

(Continued)

Jordan: “Worked on Walt and millions of hard-core Trump supporters. Say, what’s with the sling on your left arm?”

Jordan: “Worked on Walt and millions of hard-core Trump supporters. Say, what’s with the sling on your left arm?” Jordan: “Any idea how long in the sling?”

Jordan: “Any idea how long in the sling?” Jordan: “You mean such policies as tax cuts for the wealthy, tearing up trade agreements with other countries that the US drafted after WWII, efforts to severely restrict immigration and then allow only people with money to get green cards and finally citizenship. Those kinds of policies?”

Jordan: “You mean such policies as tax cuts for the wealthy, tearing up trade agreements with other countries that the US drafted after WWII, efforts to severely restrict immigration and then allow only people with money to get green cards and finally citizenship. Those kinds of policies?” Jordan: “Of course. I have three guidelines – really basic questions that might help you. The first question is about tax policy. Ready?”

Jordan: “Of course. I have three guidelines – really basic questions that might help you. The first question is about tax policy. Ready?” Jordan: “Question #2. If the Federal government wants to stimulate employment, which policy would be more effective – trying to create even more new jobs when unemployment is already low or trying to create new jobs when unemployment is high and a lot of people ae looking for work?”

Jordan: “Question #2. If the Federal government wants to stimulate employment, which policy would be more effective – trying to create even more new jobs when unemployment is already low or trying to create new jobs when unemployment is high and a lot of people ae looking for work?” Gelly: “When tax revenue is high. That’s when government should pay down debt and save for a rainy day. When the economy starts to get bad is when the government should start spending more money and create more jobs.”

Gelly: “When tax revenue is high. That’s when government should pay down debt and save for a rainy day. When the economy starts to get bad is when the government should start spending more money and create more jobs.” Gelly: “No, that would be stupid. Sounds like a waste of money.”

Gelly: “No, that would be stupid. Sounds like a waste of money.” Jordan: “Short answer is greed. The Donald was never, ever for anyone but the Donald. He did not care how economic policies affected the country as long as he and his family could make more money.”

Jordan: “Short answer is greed. The Donald was never, ever for anyone but the Donald. He did not care how economic policies affected the country as long as he and his family could make more money.” Gelly: “When you mentioned McConnell you know what popped in my head? The scene from ‘The Graduate’ where Elaine is in Benjamin’s rented room near Berkeley, she’s just screamed and the landlord is headed toward the room and turns to Benjamin. The landlord says to Benjamin, ‘You are scum.’ Seems to fit Trump, McConnell and some others.”

Gelly: “When you mentioned McConnell you know what popped in my head? The scene from ‘The Graduate’ where Elaine is in Benjamin’s rented room near Berkeley, she’s just screamed and the landlord is headed toward the room and turns to Benjamin. The landlord says to Benjamin, ‘You are scum.’ Seems to fit Trump, McConnell and some others.” Board Member: “Mr. Trump, during the break did you think about your managers’ concerns? What about their concerns was so unreasonable that you allowed the company to effectively shut down?”

Board Member: “Mr. Trump, during the break did you think about your managers’ concerns? What about their concerns was so unreasonable that you allowed the company to effectively shut down?” Trump: “You keep pointing the finger at me. I haven’t done anything.”

Trump: “You keep pointing the finger at me. I haven’t done anything.” Board Member: “…Excuse me but I wasn’t finished speaking. Let’s see if you understand this. ‘Little Donnie, quit whining like a brat, and be quiet until the adults in the room tell you it’s ok to speak. Understand?’”

Board Member: “…Excuse me but I wasn’t finished speaking. Let’s see if you understand this. ‘Little Donnie, quit whining like a brat, and be quiet until the adults in the room tell you it’s ok to speak. Understand?’” Trump: “You mean ‘The Buck Stops Here’ sign?”

Trump: “You mean ‘The Buck Stops Here’ sign?” Trump: “But I told you before about the plan to make the company great again. Step #1 is to change the compensation structure. The 1.0% management team needs more money. The peons who work for the company don’t really deserve any more money but we can throw them a few crumbs for a while…then gradually take it back. They’re too stupid to understand what’s really going on. Step #2 is…”

Trump: “But I told you before about the plan to make the company great again. Step #1 is to change the compensation structure. The 1.0% management team needs more money. The peons who work for the company don’t really deserve any more money but we can throw them a few crumbs for a while…then gradually take it back. They’re too stupid to understand what’s really going on. Step #2 is…” Board Member: “But what about their connections to shady Russian oligarchs, let alone Putin? Associating with the Russians will compromise the company.”

Board Member: “But what about their connections to shady Russian oligarchs, let alone Putin? Associating with the Russians will compromise the company.” Board Member: “Mr. Trump, the trickle-down approach, which president George H.W. Bush called voodoo economics, has never worked. He was right. Trickle down has never worked in the US or anyplace in the world. The trickle-down approach slows economic growth, not accelerate it. You know that don’t you?”

Board Member: “Mr. Trump, the trickle-down approach, which president George H.W. Bush called voodoo economics, has never worked. He was right. Trickle down has never worked in the US or anyplace in the world. The trickle-down approach slows economic growth, not accelerate it. You know that don’t you?” Board Member: “You realize, of course, the workers contributed to their medical plan and their retirement plan. And they’ve done so for a long time. Your plan will basically screw them.”

Board Member: “You realize, of course, the workers contributed to their medical plan and their retirement plan. And they’ve done so for a long time. Your plan will basically screw them.” company going forward.”

company going forward.” Economics and do my regular job. Well…”

Economics and do my regular job. Well…” is the primer page on the site?”

is the primer page on the site?” ranted and raved, asking, “Why should we use government money to bail out Chrysler and General Motors?” The comments continue, “Management at these companies has made bad decisions, UAW wages are too high and no one wants to buy their cars. Besides, Toyota, Honda, Nissan, Hyundai and Mercedes all make vehicles in the United States.”

ranted and raved, asking, “Why should we use government money to bail out Chrysler and General Motors?” The comments continue, “Management at these companies has made bad decisions, UAW wages are too high and no one wants to buy their cars. Besides, Toyota, Honda, Nissan, Hyundai and Mercedes all make vehicles in the United States.” What makes me an expert? My comments are based on some fundamental laws of economics and 40+ years in the auto business. The auto experience includes being inside a large auto company as well as starting several companies offering hybrid-electric or 100%-electric drive systems. I’ve been in technology centers, on factory floors, in boardrooms, in design centers and in dealership showrooms and service bays. I’ve been involved with some good, some bad and some ugly projects.

What makes me an expert? My comments are based on some fundamental laws of economics and 40+ years in the auto business. The auto experience includes being inside a large auto company as well as starting several companies offering hybrid-electric or 100%-electric drive systems. I’ve been in technology centers, on factory floors, in boardrooms, in design centers and in dealership showrooms and service bays. I’ve been involved with some good, some bad and some ugly projects. What makes the auto industry different from most other industries is a combination of large-scale, complex manufacturing and demands for extremely high levels of reliability and durability, especially compared to other products. Everyone I have ever met who entered the auto industry after time in another industry makes the same comment after 2-3 weeks, “The auto business is much more complicated than I realized.” And the comment usually includes several expletives.

What makes the auto industry different from most other industries is a combination of large-scale, complex manufacturing and demands for extremely high levels of reliability and durability, especially compared to other products. Everyone I have ever met who entered the auto industry after time in another industry makes the same comment after 2-3 weeks, “The auto business is much more complicated than I realized.” And the comment usually includes several expletives. Thus, for technology to be introduced in cars and trucks – even very expensive vehicles – cost must drop 1 to 2 orders of magnitude, or more than 90%, from cost acceptable for a defense or aerospace application.

Thus, for technology to be introduced in cars and trucks – even very expensive vehicles – cost must drop 1 to 2 orders of magnitude, or more than 90%, from cost acceptable for a defense or aerospace application. Well, you say, “I still don’t understand why we need to bail out GM and Chrysler. Seems like the government is pouring money down a hole.” As a point of clarification, when I talk about the auto industry, I mean more than just assembly plants. The core of the auto industry is primarily component design and manufacturing. The assembly plants get all the glamour but industry guts are in components – electronics, robots, batteries, wheels, frames, tires, steering, foundries for engines and brakes and many other components.

Well, you say, “I still don’t understand why we need to bail out GM and Chrysler. Seems like the government is pouring money down a hole.” As a point of clarification, when I talk about the auto industry, I mean more than just assembly plants. The core of the auto industry is primarily component design and manufacturing. The assembly plants get all the glamour but industry guts are in components – electronics, robots, batteries, wheels, frames, tires, steering, foundries for engines and brakes and many other components. Further, some technology breakthroughs have a long-lasting impact. An example is the effort by GM in the early 1990’s to develop and introduce an electric vehicle, known as the GM EV1. While GM was praised for introducing the car, and skewered when stopping production, the advances in technology developed for the EV1 program became the foundation for many of the electronics available in cars and trucks today, 20 years after the EV1 concept car was introduced at the Los Angeles auto show.

Further, some technology breakthroughs have a long-lasting impact. An example is the effort by GM in the early 1990’s to develop and introduce an electric vehicle, known as the GM EV1. While GM was praised for introducing the car, and skewered when stopping production, the advances in technology developed for the EV1 program became the foundation for many of the electronics available in cars and trucks today, 20 years after the EV1 concept car was introduced at the Los Angeles auto show. Finally, and let’s hope this never occurs again, but what happens if the U.S. needs manufacturing capacity for a large-scale ground war? A domestic auto industry, both assembly and component manufacturers will be critical for rapid conversion from automotive production to defense materiel. Having only assembly plants without domestically sourced components – engines, transmissions, axles, electronics, and so forth – offers no benefit for national security. (For insight into how the auto industry contributed to production of war materiel in WWII, visit

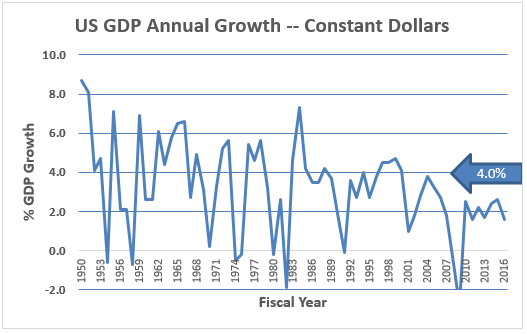

Finally, and let’s hope this never occurs again, but what happens if the U.S. needs manufacturing capacity for a large-scale ground war? A domestic auto industry, both assembly and component manufacturers will be critical for rapid conversion from automotive production to defense materiel. Having only assembly plants without domestically sourced components – engines, transmissions, axles, electronics, and so forth – offers no benefit for national security. (For insight into how the auto industry contributed to production of war materiel in WWII, visit  If you still have doubts, name one country worldwide that has sustained growth in GDP and real growth in consumer incomes without a strong manufacturing base built around a strong automobile industry? Call me when you can name one.

If you still have doubts, name one country worldwide that has sustained growth in GDP and real growth in consumer incomes without a strong manufacturing base built around a strong automobile industry? Call me when you can name one.

Gelly: “Actually, I liked the analogy. It helped me understand how wealth is created for a society rather than just an individual.”

Gelly: “Actually, I liked the analogy. It helped me understand how wealth is created for a society rather than just an individual.”  I’

I’ F

F of steps, the raw

of steps, the raw  turning the corn into ce

turning the corn into ce Medical care

Medical care Retai

Retai The reallocation is particularly true

The reallocation is particularly true  technology has replaced much of the labor content in manufacturing. And the use of technology to replace workers will only continue.

technology has replaced much of the labor content in manufacturing. And the use of technology to replace workers will only continue.