Readers: this blog is set in the future (sometime after the year 2020). Each entry assumes there has been a 5th revolution in the US — the Revenge Revolution. More about the Revenge Revolution, a list of earlier revolutions and the author, Entry #1.

Periodically I write a “sense check” to assess whether in the next few years, a revolution in the US is still possible or whether the entire exercise is based on a statistical aberration — i.e., a roughly 50-year cycle between major upheavals in the US. Most recent sense check, Entry #365.

Some of the entries are part of a series. Several series are available as easy-to-read booklets for download:

- Working with Lee Iacocca after he left Chrysler, 2019Q3 Iacocca Personal Observations.

- GM EV1 — behind-the-scenes events affecting development and introduction of the GM EV1, the first modern electric vehicle. 2020Q1 GM EV-1 Story Behind the Story Booklet

- Coming technology tsunami and the implications for the US, Tech Tsunami Booklet with Supplement

- Trump Supporters Brainwashed? A series discussing why Republics have abandoned basic principals, Are Trump Republicans Brainwashed 2020Q1

- Who took out the Donald? Who/what groups are most likely to “take out” Trump? Who Took Out the Donald Entries with Update

- Revenge Revolution — description of what form the revolution might take, 20 01 07 Start of Revolution

Prelude: there is an endless number of inconsistencies in information from the Trump administration about the spread of the coronavirus and/or actions to mitigate the spread. Rather than beat a dead horse, I’ve chosen a few that are representative but not necessarily the most egregious.

ENTRY #375 BEGINS: During the Great Depression FDR understood that instilling hope in people would help bring the country together and help reduce the likelihood of societal chaos. FDR started his first term by stating, “The only thing we have to fear is fear itself.”

FDR followed his inaugural address with a series of “fireside chats,” during which he outlined problems and proposed solutions. (If you’ve never heard any of the “fireside chats,” they’re available on the internet.) The fireside chats helped build confidence in the capabilities of the Roosevelt administration and a foundation of hope in a time of great uncertainty.

FDR followed his inaugural address with a series of “fireside chats,” during which he outlined problems and proposed solutions. (If you’ve never heard any of the “fireside chats,” they’re available on the internet.) The fireside chats helped build confidence in the capabilities of the Roosevelt administration and a foundation of hope in a time of great uncertainty.

The umbrella for recovery from the Great Depression was called the “New Deal.” The New Deal included a series of programs to provide work and income (and self-respect) for all types of unemployed workers. The New Deal work programs – WPA, CCC, and many others – included significantly expanding infrastructure in the United States, which laid the groundwork for economic growth for many decades to come.

The lesson of FDR’s understanding of creating hope and maintaining self-respect seems to have been lost on the Trump Administration. Whereas the cause of society’s uncertainty today is different than during the 1930’s, the importance of instilling hope in society and avoiding instilling fear remains the same.

Unfortunately, since day #1 in office, Trump has promoted chaos and fear. Even cabinet members who were selected because of a relationship with Trump, have been cast aside for daring to disagree with Trump. As noted in several previous entries (#374 is an example), the result of Trump‘s management style has been a cabinet that is filled with incompetents.

Trump has also consistently displayed incompetence on substantive issues. The combination has reduced people’s confidence in the ability of government to manage crises. What about the public’s confidence in the competence of the White House in dealing with the coronavirus? Did Trump take the approach of FDR and layout problems and proposed solutions?

Trump has also consistently displayed incompetence on substantive issues. The combination has reduced people’s confidence in the ability of government to manage crises. What about the public’s confidence in the competence of the White House in dealing with the coronavirus? Did Trump take the approach of FDR and layout problems and proposed solutions?

In a press conference March 20, 2020, a reporter asked Trump and Mike Pompeo, Secretary of State, when the administration first learned of the extent of the coronavirus problem in China. Pompeo asked the Homeland Security director to answer – the reply was “January 3.”

Did the Trump administration convey such information to the public? Did the administration take any action to ensure critical medical supplies would be on hand should the virus spread to the US? No, not even outside the public purview. As recently as March 3rd – two months after learning about the major problems in China – Trump declared publicly the coronavirus was a hoax.

When cases started appearing in the US, Trump claimed there were only 15 cases (there were at least 60). And of the 15 cases, Trump claimed only one or two were serious. A few days thereafter, Trump declared the virus would magically disappear, like some miracle. According to Trump, the US, unlike other countries, had the coronavirus under control.

On March 19 information became available that the Senate Committee on Intelligence had been briefed on the severity of the problem in February. The chairman of the committee, Richard Burr (R-NC), used the information to sell stock in industries that might be affected and to warn a small group of high-dollar donors about the growing problem. Did Burr inform the public? No. (Gee, I wonder what the outcry would be from Fox News, Lindsey Graham and other Trump lapdogs if Burr were a Democrat?)

Despite declarations from King Trump, the number of people infected in the US kept increasing exponentially. Then after several governors and mayors had implemented severe restrictions on travel and gatherings, King Trump declared, “I always knew this would lead to a pandemic.” Right Donald – liar, liar, pants on fire.”

Despite declarations from King Trump, the number of people infected in the US kept increasing exponentially. Then after several governors and mayors had implemented severe restrictions on travel and gatherings, King Trump declared, “I always knew this would lead to a pandemic.” Right Donald – liar, liar, pants on fire.”

Aside from the bonehead declarations by the president, the performance of the Trump administration this past week or so has been better, but remains mixed. Public confidence in the Center for Disease Control (CDC) seems to have improved as doctors have begun telling the truth about the intensity of the coronavirus and how citizens should behave. Comments from CDC personnel often have directly conflicted with claims made by Trump, even when Trump is standing next to the CDC spokesperson.

In addition, state and local officials have continued to provide guidance. Examples include governors of Michigan and Washington as well as governors/mayors in the New York tristate area. There are still some bumps in these declarations and differences of opinion but action is being taken.

As far as calming fear, Trump might have convinced the hardcore supporters he’s competent, but no one else seems convinced that he or key White House staff/cabinet officials knows what to do. Once the public began to understand more about they could be affected by the virus and then began to understand proposed government programs to respond, mild panic set in.

People rushed to buy food and staples. Stocks of toilet paper were depleted because people were concerned the material used to make facemasks would stop production of toilet paper. A simple explanation of manufacturing capacity for TP, and lead times from factory to food stores would have mitigated most concerns. A similar explanation for many food products would have helped. But as of this date, nary a word from the White House about supply chains.

The uncertainty also spooked investors, who hate uncertainty. The result has been a frenzy with huge daily swings in the market, mostly down. The major indexes, Trump’s personal barometer of job performance, have declined to a point where all the gains realized since inauguration have been wiped out. In less than two months the major indexes have fallen 25-30%.

The uncertainty also spooked investors, who hate uncertainty. The result has been a frenzy with huge daily swings in the market, mostly down. The major indexes, Trump’s personal barometer of job performance, have declined to a point where all the gains realized since inauguration have been wiped out. In less than two months the major indexes have fallen 25-30%.

The near freefall of the stock market has affected consumer confidence as has the projection of a double-digit drop in GDP in 2020:Q2, and double-digit unemployment. The trifecta hit on confidence will exaggerate the virus-related slowdown in purchases of durable goods as well as home sales and construction.

The run-up in the stock market proceeding the recent crash also left the public with another headache – an additional $1,000,000,000,000 Federal debt. The 2017 tax cut was essentially a wealth transfer program to the rich, making them even richer. Think of it as socialism for the rich. Little, if any of the tax cut actually filtered down to the middle and lower-income categories.

The end result was the rich got considerably richer and everyone else got stuck with the bill — $2,700+ for every man, woman and child in the US. For a family of four, they should think of the tax cut as their gift of more than $10,000 to the very wealthy. (For more about the fallacy of trickle-down economics, which was used to justify the wealth transfer, see blog entry xxx.)

While an economic stimulus will help some people pay bills in the short-term, the real issue is mitigating the effects of the virus. Because currently there is no vaccine (forget Trump’s claim) and no known cause, there is no way to stop infections. The government’s plan is to “flatten the curve” of the rate of infection so the number of people needing hospitalization stays within the capacity of the hospital system.

Actions to “flatten the curve of infection” include restricting the number of people who can gather together. In some areas, the restriction is 100 people, some areas it is 50 people and some areas 10 people. Surprisingly, as of 03/18, about 10 states had no restrictions, including Texas.

The flip side of restrictions on crowd control is the negative impact on commerce. Restaurants, bars, hotels, gyms, movie theaters, theme parks and even religious institutions have been ordered to close. Sporting events have been canceled or delayed. Airlines have cut back flights by 50% or more.

Even such mundane tasks as garbage pickup have been affected. In our neighborhood, the sanitation department also picks up twigs, leaves and other yard waste. This week the yard-waste truck was about an hour late because, according to a man on the truck, they could not take off because of the 50-person restriction and had to wait for the sanitation workers to leave the building. (Yard waste pickup has now been suspended.)

The effect of these restrictions will be a significant increase in unemployment and decline in GDP. Although some believe the jump in unemployment will be temporary, my belief is that any rebound in employment will leave many unemployed as organizations realize how to operate with fewer employees by implementing more technology. The depressing effect on employment could last for a number of years. (For more information about the effects of technology on potential unemployment, see ”Tech Tsunami Booklet with Supplement” )

While both economic and medical programs are needed, most proposed actions by the White House seem more focused on the economy and less on ensuring medical care is available for those affected. An example is the proposed payment of $1,000-$2,000 per family for some period. The intent seems worthwhile, helping to address income shortfalls for many service workers.

The effect of such programs on confidence is more problematic. The proposed program would link the amount of payment to family size and family income. Thus, the more income one earned (there’s a cap), the bigger the check from the government. Does anyone in the Trump administration or the Republican Senate understand basic economics? People with lower incomes who get laid off have no savings. At least give everyone the same amount.

Doubtless the irony of the proposed economic program has been lost on the White House and the Republican Senators. Isn’t giving away money directly to families socialism? Only a couple of weeks ago Republicans were characterizing as socialism any Democratic proposal for income support or student-loan forgiveness. Or, as often stated by Trumpsters, maybe such programs were really like communism. Well, aren’t socialism and communism the same?

Okay, the idea of supplementing income in the short-term makes economic sense. But there’s no need for a tax cut for corporations. In case Trump and Republicans don’t understand, taxes first require revenue and then a profit. If the public is not working there’s no demand and no revenue – and duh, no profit or tax due.

The proposed programs also have a flip side. #1, the proposed program would increase the federal debt in FY2020 at least another $1,000,000,000,000 and closer to $2,000,000,000,000. Thus, by the time Trump completes four years in office, the Federal debt will have increased more than $3,000,000,000,000…and likely more. The increase is remarkably high given that unlike Obama, Trump inherited a very strong economy that should have resulted in a smaller annual deficit and possibly annual surplus. Like I asked earlier, does anyone in the White House, Trump’s cabinet or the Republican Senate understand basic economics?

So where have all the Republican fiscal conservatives been while Trump ran up the federal debt? Apparently in hiding and waiting for a Democratic president so they can begin screaming about the level of federal debt. The scream will be the Federal debt needs to be reduced with cuts to payments for Social Security and Medicare.

Another area that can contribute to the thinking-public’s lack of confidence is the Trump administration’s effort to eliminate Obamacare. During the 2016 presidential campaign and then during three years in office, Trump has made every effort to kill Obamacare. Any Obamacare-like program was bad — oops until the coronavirus. Now many programs being proposed by the Trump administration are absolutely consistent with the purpose of Obamacare and suggest that the US would be better off with a national healthcare system. Such change in policy will only increase frustration among the populace as well as increase the lack of confidence in government.

Adding fuel to the “no-confidence” fire was Trump’s claim at a oppress conference Friday, 03/20/2020 that his administration inherited a broken healthcare system from the Obama administration but that he (Trump) had fixed it. Obviously, not everyone agreed. The lead doctor at CDC put his head in his hand as Trump spoke.

Where does all the inconsistency and uncertainty lead? Uncertainty, as discussed in a number of previous blog entries, is often a precursor to a revolution. The US might get lucky and avoid a 5th revolution by voting out Trump and most of the Senate in the November 2020 election.

As of today, even though the coronavirus crisis is still in the early stages, the public seems more than willing to accept Depression-era types of programs to help stimulate the economy and begin to help reduce the income inequities that currently exist. Such programs are more consistent with the Democratic Party and would seem to bode well for the election of Joe Biden.

However, if for whatever reason Trump is re-elected, then the level of chaos and uncertainty experienced during the first term is likely to intensify. While the hard-core Trumpsters might be satisfied, the majority of the population will not be. The extreme discord between the hard-core Trumpster and rational people will increase the probability of a 5th US revolution.

As described throughout the blog, the revolution will be some type of revenge against the elite that Trump continues to support. The revolution – the Revenge Revolution – also will include many of the hard-core who finally wake up to the reality of how much Trump has screwed them.

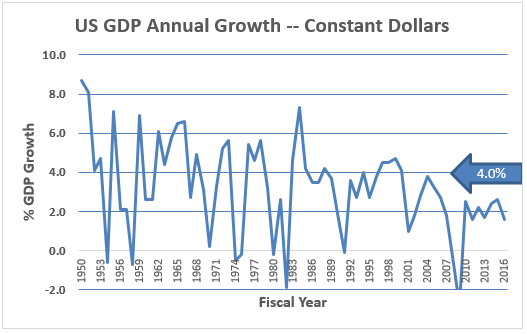

Product) was up less under Obama than Bush 43

Product) was up less under Obama than Bush 43